Payroll expense calculator

But instead of integrating that into a general payroll calculator. Vacation hours exemption status deductions and more.

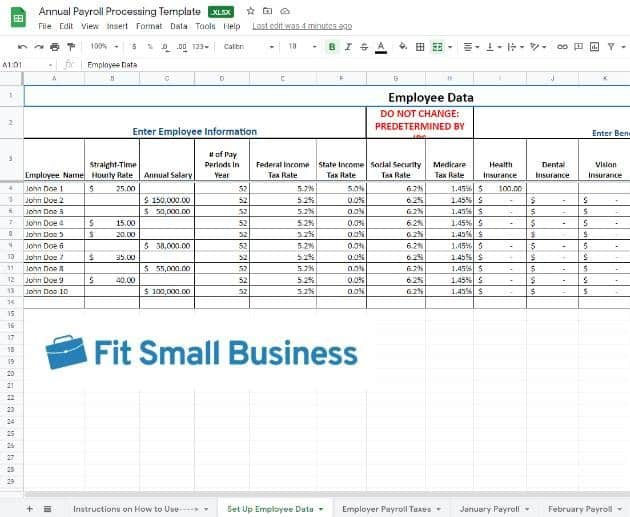

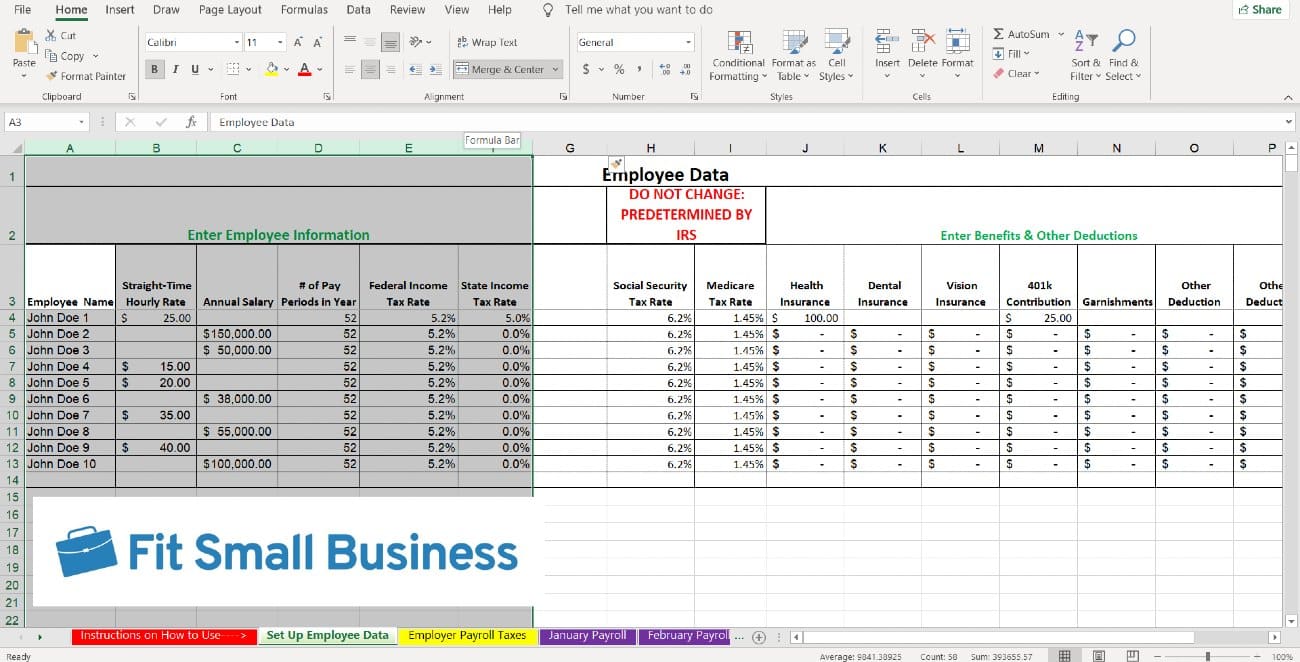

Payroll Calculator Free Employee Payroll Template For Excel

If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise.

. This calculator allows participants to calculate an unofficial estimated projection of a pension benefit based on information entered. O is for the principal amount. Health benefits automatic savings 401ks and more.

COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor cost and. The formula for the operating expense can be derived by using the following steps. Considering the start date and payment schedule it fetches the dates.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. Printable Pay Stub Template - PDF. Other duties include managing the company budget and expense as well as cooperating with different departments to increase payroll service performance and improve upon the payroll system.

Instructions for using the e-signing and e-stamping service If you are a client of HROne HROne can provide you with electronic contract signing service for free and the electronic contract platform is recognized in judicial practiceSpecific instructions for. If your personal or financial situation changes for 2022 for example your job starts in summer 2021 and continues for all of 2022 or your part-time job becomes full-time you are encouraged to come back in early 2022 and use the calculator again. Calculate your CPF and SDL online for free with JustLogins CPF Calculator Tool.

Fast ReliableGreat supportSignup TODAY. HRmys Free Payroll Features. At any time you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month.

Forms - Payroll Documents on this page are in Adobe pdf Word doc Word docx and Excel xls formats. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Employer of Household Workers Quarterly Report of Wages and.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. PPSD provides information required to manage the personnel resources of the state and to properly account for salary and wage expenditures provides data to the retirement systems necessary for calculation of employee retirement benefits and manages the states automated travel expense claim system. Firstly determine the COGS of the subject company during the given period.

The Schedule sheet consists of the following columns. Easy to use Payroll Calculator in Excel. For a complete payroll software compliant with CPF IRAS and MOM try JustLogins Payroll.

ESmart Paycheck is a free payroll calculator that can quickly compute payroll for hourly or salaried workers while taking care of 401k contributions and other deductions. Quarterly Contribution Return and Report of Wages DE 9. If youre an employee then you pay one half of this total probably as a withholding on your paycheck.

Payroll Tax Definition. After you complete calculations for your employees you can also view print and save a summary of your employer remittance amounts from a separate page. Payroll Calculator Excel Template Features Summary.

To complete a paper copy off-line. Leave Accounting MN PS350S. Reports Annual Statement Fund Details Trustee Officer.

Principal amount Interim Payment Interest Amount. In addition to simplifying payroll the payroll calculator helps you know how much you owe the CRA at the end of each month. The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper.

Then enter the employees gross salary amount. You can use the payroll calculator sheet as a pay stub showing tax withholdings and other deductions gross and net pay and an itemized list of hours by. Most features are available to employees via the mobile app such as marking attendance applying for leaves submitting expenses submitting their tax information tracking attendance reimbursements and leave approvals viewing and searching personnel records receiving internal news and updates.

Why Gusto Payroll and more Payroll. No the calculator assumes you will have the job for the same length of time in 2022. Access to payroll reports advanced online employee scheduling time tracking and paid time off tracking.

This Payroll Calculator Excel Template supports as many employees as you want. Serial Number of the payments. It also automates payroll includes an employee self-service portal and offers some human resources HR tools.

SAVE TIME MONEY Time Clock Hub saves businesses an average of 3700 annually by eliminating overpayments to employees. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. In addition to this our Paycheck Tracker has a dashboard to see cumulative earnings as well as a separate section to print out the selected employees payments.

Gusto payroll seamlessly integrates with the leading accounting services employee time tracking software and more. Users can also import timesheets expense reports and share documents via the softwares workflow function. Additional payments made at payment periods.

Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW. Labor Relations MN PS180S. JustLogin provides a full suite of integrated HR modules including Payroll Leave Attendance and Expense that allow you to easily automate your HR processes.

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Upon processing your first payroll you can use Wave Payroll for up to 30 days commitment-free. Payroll taxes are part of the reason your take-home pay is different from your salary.

Automatic deductions and filings direct deposits W-2s and 1099s. A payroll specialist is primarily responsible for processing payroll and maintaining the employee database regarding salary and pay. Employee Business Expense MN PS400S.

SumoPayroll is Indias fast growing free online payroll management software hosted on cloud. The template uses the rates of Interest. Weekly Expense Report Template - Excel.

Your employer pays the other half for you and then gets a deduction for their half on their corporate tax return since its an expense - for them its as if the FICA half is an additional piece of salary. Expense Expense E1 Expense E2 Expense E3 Expense E4 Expense E5 Expense E6 Expense E7 Expense E8. It regularly tops lists of the best payroll software for small businesses.

Employee Maintenance MN PS150S. Gusto has a free employer tax calculator which provides an accurate estimate of how much youll have to pay in payroll taxes over a year. Want to simplify things.

When you start a new job and fill out a. Exempt means the employee does not receive overtime pay. Employees have access to the web and mobile app Perk Payroll solution.

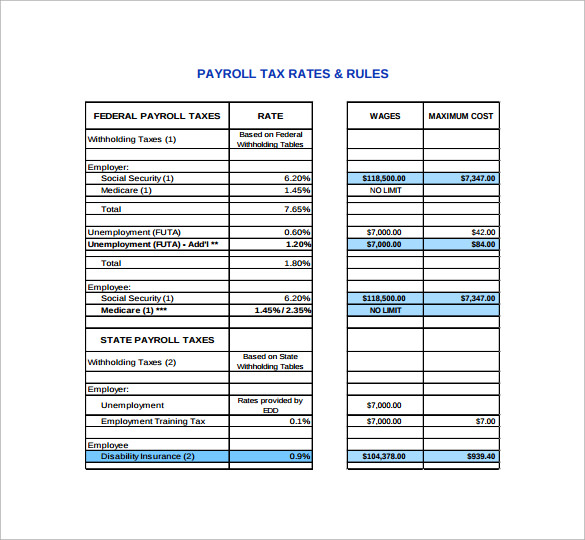

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator Take Home Pay Calculator

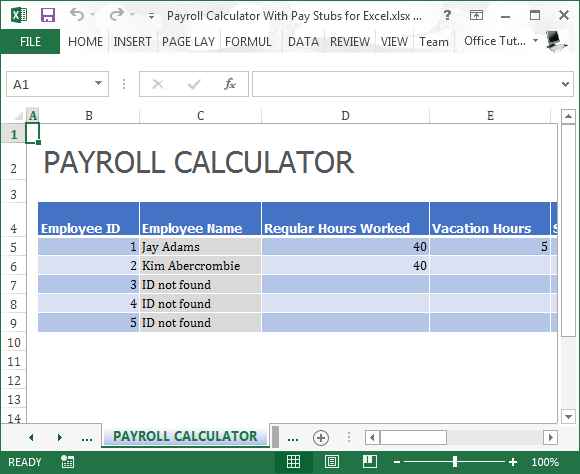

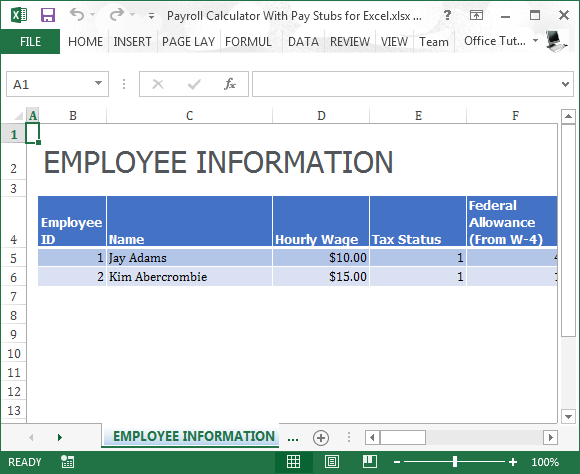

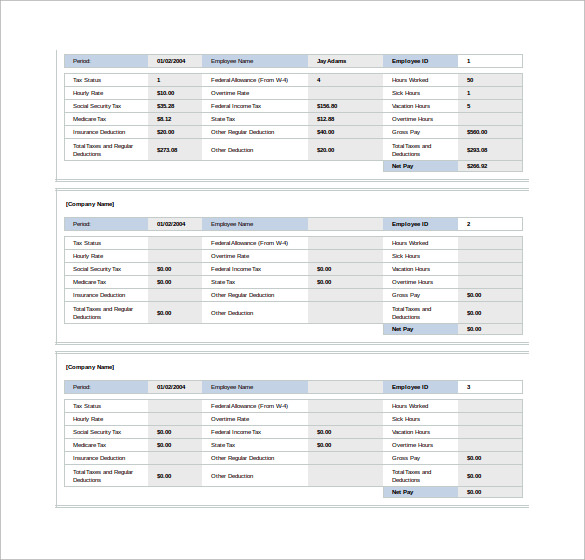

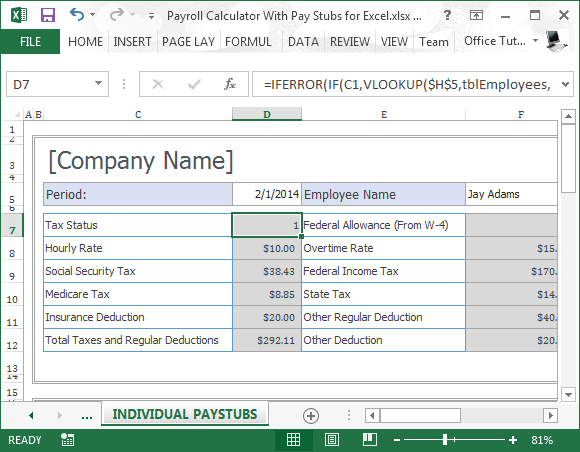

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

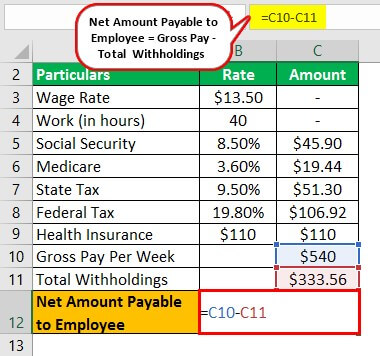

Payroll Formula Step By Step Calculation With Examples

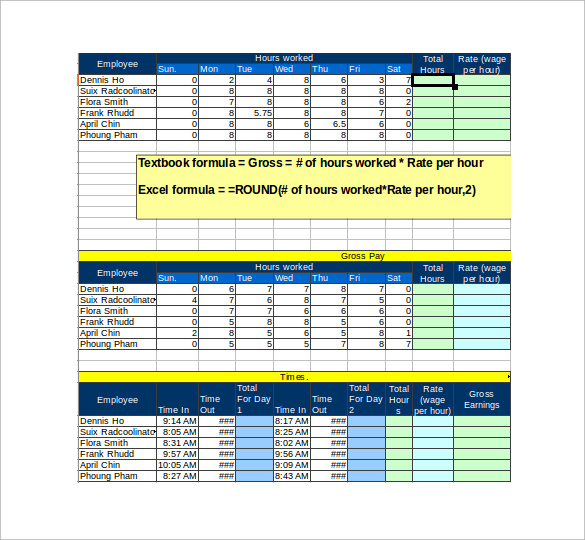

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Taxes On Payroll Discount 57 Off Www Ingeniovirtual Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Tax Calculator For Employers Gusto

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Calculator With Pay Stubs For Excel

How To Calculate Taxes On Payroll Discount 57 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Discount 57 Off Www Ingeniovirtual Com

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate 2019 Federal Income Withhold Manually